If your emails make it through SPAM filters, you still need to get your email noticed with a subject line or preview text that grabs the customer’s attention. Even if your email is read, your customer still needs to act on your message. Compelling content can help make your message persuasive, and a personalized message can make your customer more likely to act on your request for payment. Effectively using calls to action in your email can help to collect payment quickly.

Here are some suggestions on how to effectively use calls to action to collect payment quickly.

One Call to Action

Use only one, clear call to action. It could be a plain hyperlink, a button that says “make payment”.

No Attachments

Don’t include attachments to your emails. If you want to send your recipients a PDF or Word document, don’t attach the file to the email – otherwise your email could be blocked by SPAM filters.

Example

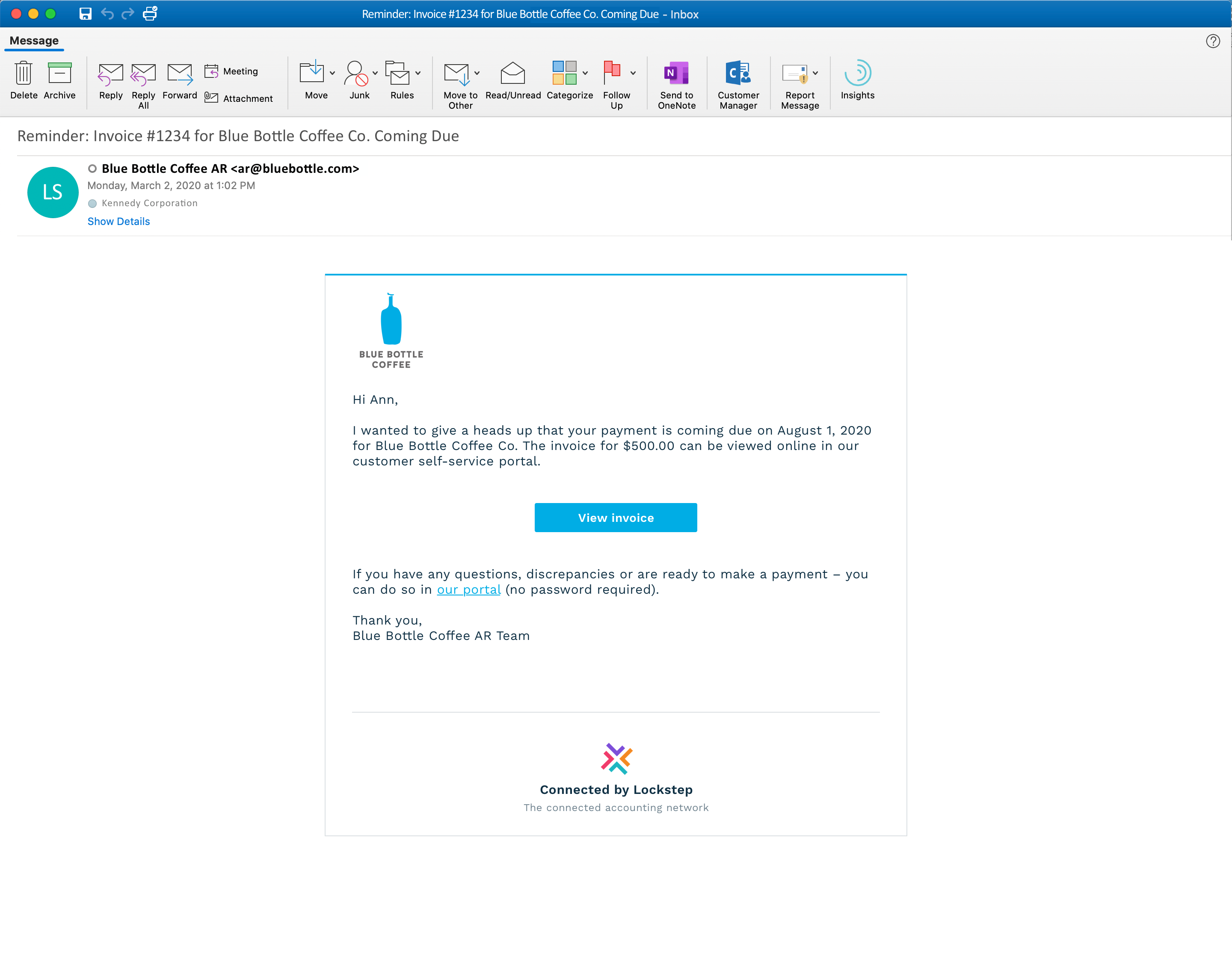

Here is a typical reminder email sent from Lockstep Collect:

Sequencing

Using sequencing, Lockstep Collect users can group their customers into buckets based on past due, as well as whether they need white glove service or any other identifying information. These email templates have all the information a customer needs to pay on time using “snippet codes”. The snippet codes pull in the customer data to personalize email information like: days past due, first name, company name and more.

Portal

There is one clear call to action in the example email, which when clicked takes the customer to an online portal to make payment. Lockstep Collect uses a call to action for the portal because it is more likely for an email to be sent to SPAM with attachments for invoices and statements.

Based on Lockstep Collect benchmark data, customers who implemented online payments for customer self-service saw an average decrease of ADD of 14 days and a decrease in past due.

With an Lockstep Collect online portal customers can make a payment, dispute an invoice, promise to pay, download attachments like invoices and statements, and send a message to collectors from inside the portal.

Effectively using calls to action can help collect payments quickly. Automated credit and collection solutions can help can help overcome collection barriers, and increase collections and cash flow.

Lockstep Collect, a leader in cloud-based credit and collection solutions, provides automated solutions for managing credit and collections. Lockstep Collect is an experienced software partner that can help you maximize your collections and cash flow in the new normal.

If you would like to learn more about how you can benefit from automated credit and collection solutions, please contact Lockstep Collect at www.lockstep.io.