Our cloud-based software plugs right into your accounting system and automates your entire AR collection process. See a 20x ROI by investing in AR Automation.

Ready to learn more?

Fill in the form to speak to one of our solution experts and get a personalized demo.

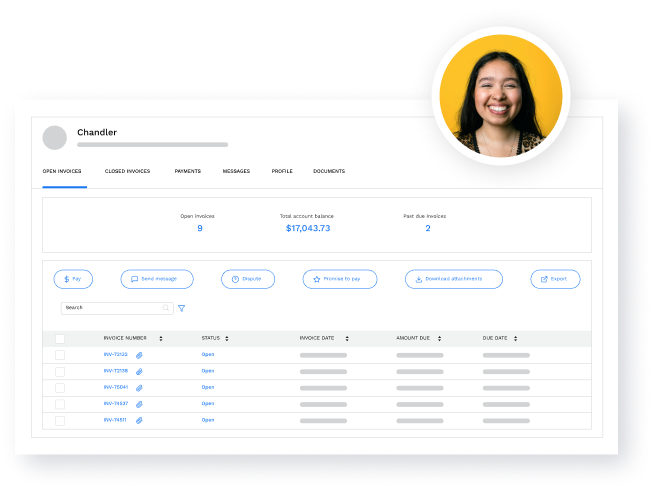

“I love the fact that when we send out an email our customers have a portal to their account where they can print their own invoices, should they be missing one.

Credit and Collections Specialist

BEGA

Are you doing the

right activities to

get paid ontime?

Collections effectiveness means doing the right things to get paid. Download our eBook analyzing AR automation impacts across a wide number of companies and industries with Sage AR Automation software.

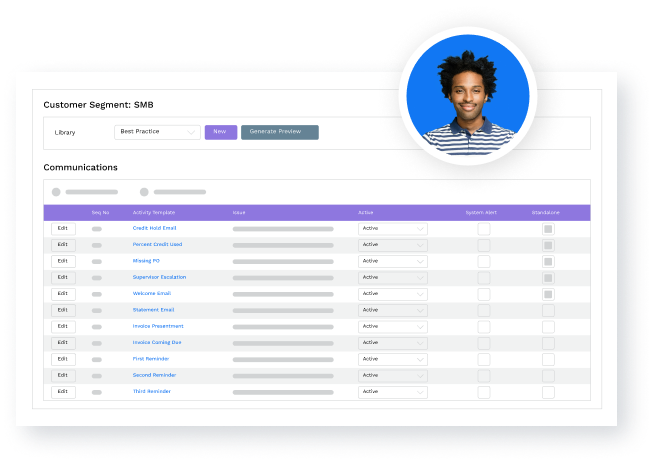

Automated

Customer Communications.

Connect with more customers, faster using automated communications. Optimize your invoice communication workflow by leveraging our best-in-class library of templates and rules that can easily adapt to match your specific requirements across the entire customer lifecycle.

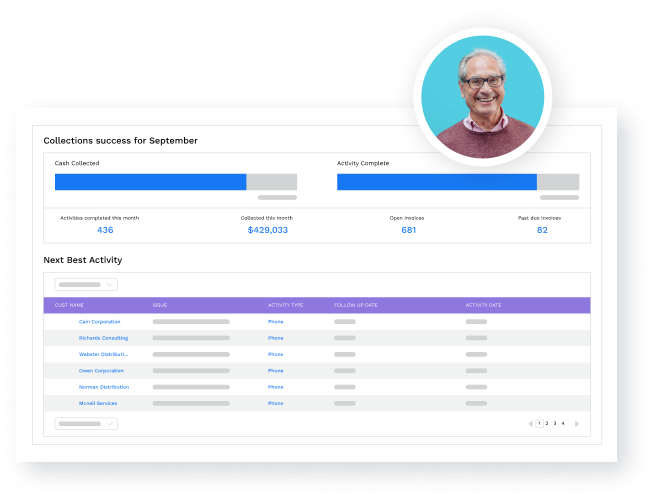

Collections

Activity Management

Connect your team with critical customers and convert trapped receivables into cash. Leveraging an automated next best activity list and a comprehensive view of each customer’s account and collections status, your team can quickly and efficiently resolve payment issues, drastically reducing days sales outstanding (DSO).

Customer

Self-Service

Connect customer remittance to the right invoice automatically, making real-time payments a reality.

Fast-track cash application by automatically aggregating remittance across multiple sources and linking them to the right customers and invoices, putting cash in your accounts faster.

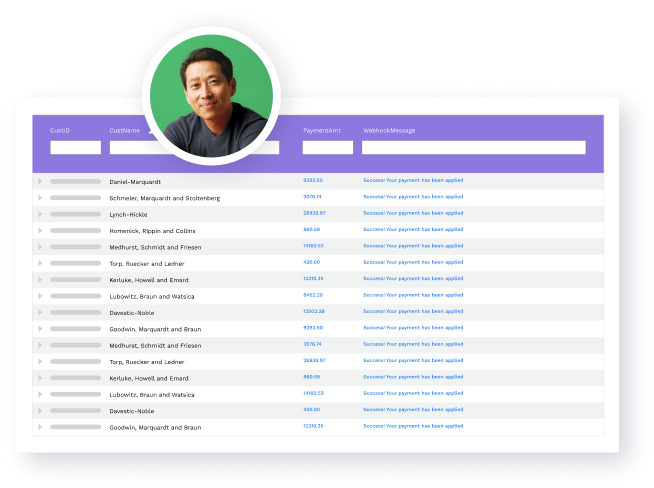

Cash Application

Management

Connect customer remittance to the right invoice automatically, making real-time payments a reality.

Fast-track cash application by automatically aggregating remittance across multiple sources and linking them to the right customers and invoices, putting cash in your accounts faster.

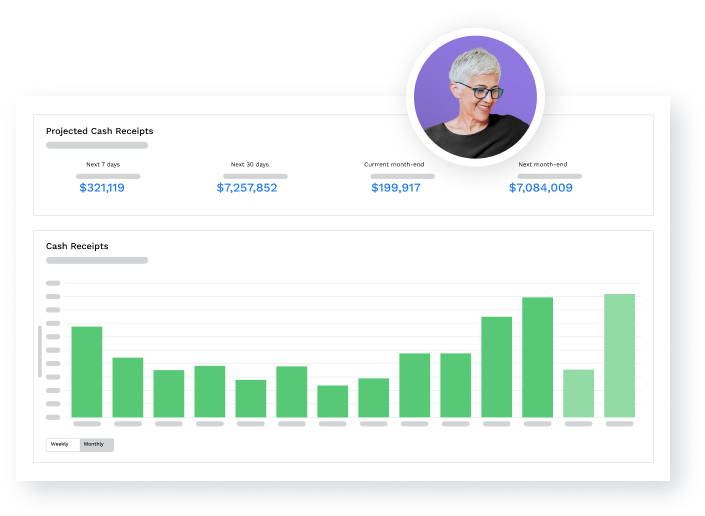

Forecasting

and Reporting

Connect key stakeholders with visibility into cash flow and DSO with custom reports and automated distribution.

Get visibility into cash inflow based on customer payment behavior while monitoring adoption and tracking usage of online accounts and payments.